Definition

A measure of a company’s profitability is calculate by dividing quarterly or annual income (minus dividends) by the number of outstanding stock shares.

{tocify} {$title=Table of Contents}

Earnings per share and Diluted EPS are the main indicators for investors. Because they show a company’s financial health. Basically, EPS is calculated by dividing the net income with the total number of outstanding shares/stocks.

Diluted EPS takes into account convertible securities, such as convertible preferred shares and employee stock options. Both of the above metrics are use to evaluate a company’s performance, forecast future earnings, and compare to its competitors.

EPS is a basic factor for determining the value of a company’s stock. So basically, it is a performance indicator. It shows how much profit a company is generating per share. This indicator is use by investors to find whether a stock is undervalued or overvalued.

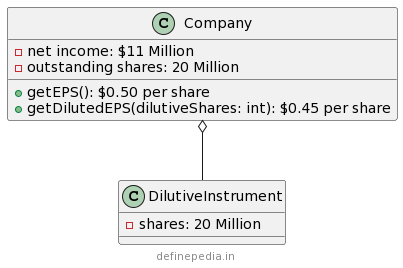

Let’s now look at how to compute EPS. It is calculate by dividing a company’s net income by the number of outstanding shares of common stock. Let’s take an example, if a company has a net income of Rs 1 million and 100,000 common stocks outstanding, its EPS is Rs 10.

Investors use EPS in various ways. For example, they compare a company’s EPS with its historical EPS to determine if it’s improving or decreasing.

Investors usually use EPS to calculate other metrics. Such as the price-to-earnings ratio (P/E ratio), which helps them to determine. Is the stock is overvalued or undervalued?

So basically, I want to tell you that EPS is a critical financial metric use by investors to evaluate a company’s profitability and determine the value of its stock. As an investor, you must know how EPS is calculate and how to apply it to make sound investment decisions.

One disadvantage of basic EPS is that it doesn’t take into account the impact of dilutive securities. This can lead to inaccurate calculations, especially if a lot of dilutive securities are issued.

Definition of Diluted EPS

Diluted EPS is a profitability calculation that measures the amount of income each share will receive if all convertible securities are exercise.

It is calculate by dividing a company’s net income by the total number of outstanding shares. Basically, it includes any additional shares that would be created from the conversion of convertible securities.

Diluted EPS is commonly lower than basic EPS because it takes into account the potential dilution of earnings per share from convertible securities.

EPS can be use to compare with share price to determine the value of the company. EPS is also use to calculate the value of a company’s stock.

The primary advantage of diluted EPS is that it takes into account the impact of dilutive securities. This can lead to more accurate calculations, even if a lot of dilutive securities are issue.

Factors of EPS and Dilute EPS

Factors that can affect EPS and Diluted EPS.

Revenues

One factor that can impact EPS and diluted EPS is revenues. Generally speaking, higher revenues indicate greater profitability. It can lead-in to higher EPS/Diluted. Other hand, high expenses can decrease a company’s net income and lower its EPS and as well as diluted EPS.

Taxation

Another important factor to consider is taxation. A company’s tax rate can have a big impact on its net income, which in turn affects its EPS and diluted EPS. Additionally, competition in the market can impact a company’s sales and revenue. It can turn, affect its EPS and diluted EPS.

Interest rates & Market conditions

Changes in interest rates and market conditions can also have an impact on both. Interest rate changes can impact a company’s borrowing costs and, turn in, its net income and EPS. Market conditions such as economic growth, inflation, and consumer confidence can also affect a company’s revenue and net income, which in turn affects its EPS and diluted EPS.

Mergers and Acquisitions

It can impact a company’s EPS and diluted EPS by increasing or decreasing its outstanding shares, while share buybacks can impact EPS and diluted EPS by reducing the number of outstanding shares. Issuing of stock options and convertible bonds can also affect diluted EPS by increasing the number of potential outstanding shares.

It is important to remember that a single EPS value for a company is not enough to fully understand its financial performance. Rather, it should be analyze in comparison to other companies in the industry and against the company’s share price (the P/E ratio) to determine its true profitability.

Disadvantages of Dilute ESP

The main limitation of Diluted EPS is that it can be more difficult to calculate than Basic EPS due to the complexity of taking into account potential dilutive securities.

Additionally, companies have a lot of discretion when deciding what is and is not include in adjusted EPS, and investors must consider the number of shares outstanding, the potential for share dilution, and earnings trends over time when evaluating EPS.

Generally, Diluted EPS will always be lower than Basic EPS if the company creates a profit because that profit has to be divide among more shares.

One disadvantage of diluted EPS is that it is more complex/hard to calculate. This can make it difficult for investors to understand a company’s earnings.

It can be manipulated by share buybacks or issuing stock options. It can unnaturally increase EPS and make it appear as if the company is performing better than it actually is.

Diluted EPS, Other hands, accounts for possible earnings dilution from stock options, convertible bonds, and other financial instruments. However, the computations for diluted EPS can be highly complex, and it can be difficult to compare diluted EPS between firms.

In addition to these limitations, it is important to consider the text in which EPS is being use. EPS is valuable for comparing a company’s performance to that of its peers. But it is not the only indicator to examine.

While considering a company’s financial success, other financial measures. Such as return on investment and net income should be considere also there.

| EPS | Diluted EPS |

|---|---|

| Calculated by dividing a company’s net income by the number of outstanding shares of common stock | Takes into account the potential dilution of earnings from convertible securities, stock options, and warrants |

| Represents a company’s earnings per share of common stock | Represents a company’s earnings per share if all potentially dilutive securities were exercised or converted |

| Does not take into account the effect of any potentially dilutive securities | Takes into account the effect of any potentially dilutive securities |

| Calculated by dividing net income by the total number of shares outstanding, including common and preferred shares | Calculated by dividing net income by the total number of shares outstanding, including common and preferred shares, as well as potentially dilutive securities |

| EPS is usually higher than Diluted EPS | Diluted EPS is usually lower than EPS |

| Used to measure a company’s profitability and financial health | Used to measure a company’s profitability and financial health, taking into account the potential dilution of earnings from convertible securities, stock options, and warrants |

| Does not provide a complete picture of a company’s earnings potential | Provides a more accurate picture of a company’s earnings potential, accounting for potentially dilutive securities |

| Does not reflect the impact of stock options, convertible securities, or warrants on earnings per share | Reflects the impact of stock options, convertible securities, or warrants on earnings per share |

| Commonly used in financial statements and earnings reports | Commonly used in financial statements and earnings reports |

| Does not show the impact of share dilution on earnings per share | Shows the impact of share dilution on earnings per share |

Was this helpful?

0 / 0