Financial statement analysis is the process of examining a company’s financial statements to understand its health, check financial performance, and make decisions about business value.

Financial statement analysis is important for businesses. Because it provides a picture of a corporation’s financial health, giving wisdom into its performance, operations, and cash flow. It helps businesses to comply with business laws and regulations while meeting the needs of stakeholders and various other parties.

{tocify} {$title=Table of Contents}

Financial analysis is a cornerstone of making smarter, more strategic decisions. Based on the underlying financial data of a company.

Trend analysis is a statistical technique for identifying patterns in data. It entails gathering and analyzing data over time in order to reveal insights and patterns that would be difficult to notice otherwise.

Hence, by employing trend analysis, you may easily make the right decisions about your company’s future. For example, you can identify those areas where you can make opportunities/chances to grow. This information will help you to plan and assign resources. As well as make important decisions that can improve your bottom line.

To conduct trend analysis, you need to collect and organize your data into a time series. This could be anything from sales figures to website traffic data. Once you have your data, then you can easily plot/place it on a graph and also look for the patterns. If the trend is linear, you can use formal regression analysis to estimate the trend.

The benefits of trend analysis are numerous. For example, it enables you to make data-driven decisions based on real-world results.

Additionally, It can help you stay ahead of the competition by identifying opportunities/chances before they become noticeable to others. It can also help you in risk reduction by providing a deeper knowledge of the dynamics that drive your organization.

Trend analysis is a strategy used in making future predictions base on historical data. It involves sorting/grouping through past data to answer what happened and then using that information to figure out how the future may look. Trend analysis can be used in finance, commercial or government organisations. To predict costs and demand. It can also be use to forecast the long-term direction of market sentiment.

Is the technical analysis used in trend analysis?

Yes, technical analysis is used in trend analysis involves studying historical market data. Such as price and volume, to predict future market behaviour. Basically, it also uses technical indicators to help investors identify price trends. As a result, trend analysis forecasts the long-term direction of the market sentiment using past data such as price fluctuations and transaction volume.

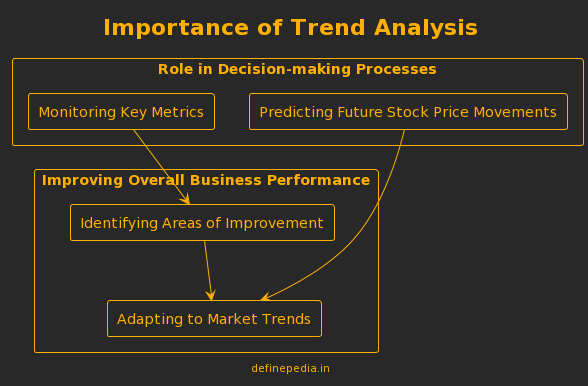

Importance of Trend Analysis

Trend analysis is important in decision-making processes, monitoring key metrics and their development over time, predicting future stock price movements, and improving overall business performance. It is a technique use to examine and predict the movements of an item base on current and historical data.

Trend analysis is based on the concept that past data can be use to help predict the future. And basically, it uses financial statements to recognize patterns in the market and forecast future performance. In most organizations, trend analysis is use to monitor metrics and their development over the period.

Decision-making

One of the major benefits of trend analysis is its role in decision-making processes. By monitoring key metrics and their development over time, you can identify areas of your business . Its performing is well and those that need improvement. So basically, this allows you to focus on your resources and efforts in the areas. It will have a great/major impact on your business.

For example, let’s assume that you run a retail store and you notice that sales of a particular product have been declining over the past few months. So by conducting a trend analysis, you may identify that this decline is due to a shift in consumer preferences or increased competition. Armed with this information, you can make informed decisions on how to respond, such as adjusting your product offerings or marketing strategies.

Predict future

Another benefit of trend analysis is its ability to predict future stock price movements. By tracking market trends and analyzing historical data, you can make more accurate predictions. About the future market trends and adjust your investment strategies accordingly.

Business performance

Trend analysis can also be used to improve overall business performance. By comparing your business against other businesses in your industry. You can establish a benchmark for how your business should be operating. This allows you to adapt and change your business to stay current and ahead of the competition.

For example, let’s say you run a restaurant and notice that your average ticket size is lower than that of your competitors. By conducting a trend analysis. You may identify that this is due to a lack of upselling or cross-selling opportunities. Armed with this information. You can train your staff to offer extra menu items or promotions to increase your average ticket size.

Was this helpful?

0 / 0