So basically financial markets facilitate the sale and purchase of assets, such as bonds and equities. They help direct the flow of savings and investment in the economy. It facilitates capital collection.

Markets play an important role in the economy by managing the flow of capital and allowing individuals and businesses to manage their financial risk accordingly.

The importance of financial markets in the economy cannot be magnified. They help to distribute the resources to their most productive uses. So by allowing investors to purchase shares in companies they believe have strong growth potential. As a result, businesses are encouraged to invest in innovative ideas and technology that will help the economy thrive.

Furthermore, financial markets enable individuals and companies to manage their financial risk. A firm, for example, may use the futures market to hedge against a prospective increase in raw material costs.

Similarly, individuals can limit their risk exposure by investing in a diverse range of assets.

Financial markets basically include these, stock market, bond market, forex market, and derivatives market. Each of these markets has its unique characteristics and serves a different purpose.

In conclusion, financial markets play a critical role in the proper running of modern economies. Knowing how financial markets work is required for everyone who wants to invest or manage their money successfully.

Definitions

E.W. Walker stated, Activities of a business concern relevant to financial planning, coordinating, control and their application is called finance.”

L. J. Gitman said that Finance can be defined as the art and science of managing money. Finance is concerned with the process, institutions, markets and instruments involved in the transfer of money among and between individuals, businesses and governments.”

Schall & Hally said that Finance is a body of facts, principles and theories dealing with raising and using money by individuals, businesses and governments.

Financial institutions are businesses that handle the exchange of funds between savers and borrowers. They offer accounts to the savers and, in turn; the money deposited is used to buy the financial assets issued by other forms.

Basically, they also issue financial claims against themselves and the proceeds are used to buy the securities of other firms.

The financial system in India is composed of 4 components:

- Financial institutions

- Financial markets

- Financial instruments

- Financial Services.

The financial system is a connecting link between savers of money and uses of money and promotes faster economic growth. India’s capital market provides long-term finance for businesses.

Types of Financial Market

- Money Market

- Capital Market

Money Market

A money market is a financial market where parties can buy and sell short-term debt instruments. Such as Treasury bills, certificates of deposit, commercial paper, and other highly liquid and low-risk securities. Characteristics include high liquidity, low risk, and short-term maturities.

These securities are highly liquid and often have a maturity period of less than one year. The money market’s primary job is basically to provide short-term funding for businesses and governments.

Money market features include high liquidity, minimal risk, and low rewards. So due to the low risk involve it with money market securities, they typically offer lower returns compared to other financial assets.

Examples include Treasury bills, certificates of deposit, and commercial paper.

Treasury bills

Basically, these are commonly referred to as T-bills. The government issues these short-term debt instruments to fund its operations. They have a maturity period of less than one year. Typically held from four weeks to one year.

T-bills are considered a low-risk investment since they are backed by the government’s full faith and credit, and the interest earned on them is free from state and local taxes. Investors can purchase T-bills directly from the government or through a broker.

Certificates of deposit (CDs)

These are issued by banks and other financial institutions to depositors. CDs are time deposits with a fixed maturity period, typically ranging from three months to five years. They offer a fixed rate of interest, which is higher than the interest offered on savings accounts.

CDs are considered to be a low-risk investment as they are FDIC-insured up to Rs 250,000 per depositor per insured bank.

Commercial paper

These are basically short-term debt instruments issued by corporations to finance their short-term funding requirements. They have a maturity period of less than one year, typically ranging from one day to 270 days.

Commercial paper is unsecured, which means that it is not backed by collateral. However, it is issued by financially strong companies, making it a relatively low-risk investment. Investors can purchase commercial paper directly from the issuer or through a broker.

Capital Market

A capital market is a financial market where participants can buy and sell long-term debt or equity-backed securities. The characteristics of the capital market include higher risk and higher returns compared to the money market. Capital market instruments are considered to be more riskier, but they also offer potentially higher returns to investors.

It also includes long-term maturities, higher risk than money markets, and higher returns than money markets. Examples include stocks, bonds, and mutual funds.

Mutual funds

These are a type of investments where money is pooled from multiple investors and then used to buy a portfolio of assets managed by a professional portfolio manager. This portfolio can include a mix of stocks, bonds, and other assets.

Asset classes are categories of investments that share similar characteristics and behave similarly in the market. The three main asset classes are equities (stocks), fixed income (bonds), and cash equivalent or money market instruments.

Bonds are debt securities that pay a rate of return in the form of interest. Other assets can include mutual funds, exchange-traded funds, real estate, commodities, and more.

Mutual funds offer diversification and professional management, making them a popular choice for investors.

Exchange-Traded Funds (ETFs)

These are similar to mutual funds but are traded like stocks on an exchange. ETFs can also offer diversification and low fees, making them a popular investment option.

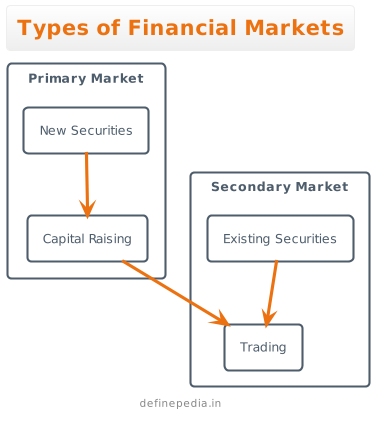

Primary market

It is also known as the recent issues market. It is where freshly issued securities, such as stocks and bonds, are offered to the public for the first time.

So this is where companies raise capital by offering their shares or bonds to investors.

Types of primary market issues include initial public offerings (IPOs), private placements, rights issues, and preferred allotments.

Secondary market

Other hands, the secondary market, also known as the stock market, is where previously issued securities are traded between investors. This is where buyers and sellers come together to trade existing securities. Such as stocks, bonds, and other financial instruments.

Stock exchanges represent the most common form of secondary markets.

It is important to note that while the primary market is where companies raise capital, the secondary market provides liquidity to investors who wish to buy or sell their securities.

It is the first time that newly issued securities. Such as stocks and bonds, are made available to the public.

Was this helpful?

0 / 0