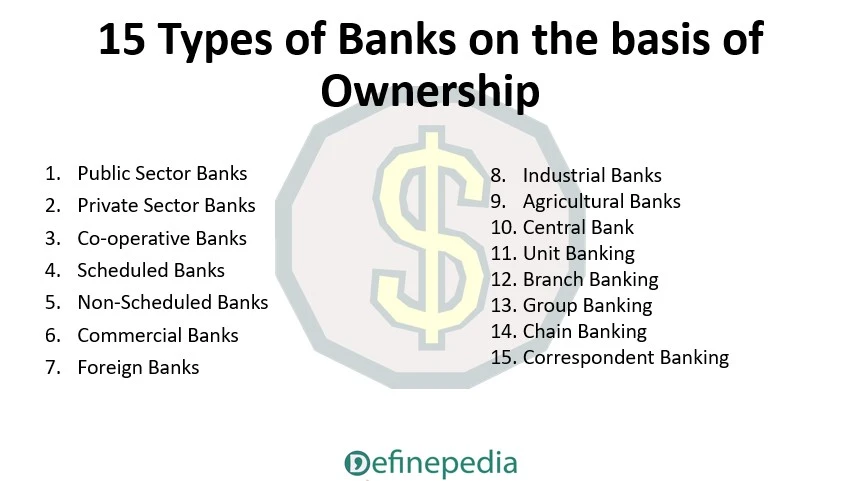

Public Sector Banks

Public sector banks are like the government’s banks. They are basically owned and operated by the government parties.

For example, the State Bank of India (SBI) is a public sector bank. These banks serve a important role in providing banking services to the general public and supporting the nation’s economic growth.

Private Sector Banks

Private sector banks, on the other hand, are owned and run by private individuals or companies. Think of them as banks that are not controlled by the government.

HDFC Bank is a well-known private sector bank. They compete with public sector banks and often offer more personalized services.

Co-operative Banks

Co-operative banks are unique because they are owned by the people who use them. These banks are like a financial team where members work together for mutual benefit.

An example is Saraswat Bank. Co-operative banks often focus on serving specific communities or regions.

Scheduled Banks

Scheduled banks are those that follow specific rules and regulations set by the Reserve Bank of India (RBI), the country’s central bank. They are considered more stable and reliable. For example, ICICI Bank is a scheduled bank. This also include Private banks , Public Banks, Foreign Banks.

Non-Scheduled Banks

Non-scheduled banks, on the other hand, do not meet all the criteria set by the RBI. They still provide banking services but may not have the same level of regulatory oversight as scheduled banks. Many local cooperative banks fall into this category.

Commercial Banks

Commercial banks are the banks most people are familiar with. They offer various services like savings accounts, loans, and checking accounts to both individuals and businesses. Axis Bank is an example of a commercial bank.

Foreign Banks

Foreign banks come from other countries but have branches in India. They cater to the needs of international travelers and businesses. Standard Chartered Bank is an example of a foreign bank operating in India.

Industrial Banks

Industrial banks focus on financing big industrial projects and businesses. They play a vital role in supporting economic growth in the industrial sector. IDBI Bank is a prominent industrial bank.

Agricultural Banks

As the name suggests, agricultural banks are dedicated to supporting farmers and activities related to agriculture. NABARD (National Bank for Agriculture and Rural Development) is a well-known agricultural bank in India.

Key Takeaways

- Public Sector Banks: Owned by the government (e.g., SBI).

- Private Sector Banks: Owned by private individuals or companies (e.g., HDFC Bank).

- Co-operative Banks: Owned by members who work together (e.g., Saraswat Bank).

- Scheduled Banks: Follow RBI rules (e.g., ICICI Bank).

- Non-Scheduled Banks: Don’t meet all RBI criteria.

- Commercial Banks: Serve individuals and businesses (e.g., Axis Bank).

- Foreign Banks: From other countries with branches in India (e.g., Standard Chartered Bank).

- Industrial Banks: Finance big industrial projects (e.g., IDBI Bank).

- Agricultural Banks: Support farmers and agriculture (e.g., NABARD).

Central Bank

The central bank is like the boss of all banks in India.

Example: Reserve Bank of India (RBI).

Its main job is to manage the country’s money supply, control interest rates, and ensure the stability of the financial system. It acts as a guardian of the Indian economy.

Unit Banking

Imagine a bank with just one office in a single location.

These banks are called unit banks.

They’re small and operate independently without branches in different places.

Branch Banking

Branch banking is when a bank has multiple offices or branches in different cities and regions.

For instance, the State Bank of India (SBI) has branches all over India.

It allows people to access their bank services conveniently, no matter where they are.

Group Banking

Group banking involves several banks working together as part of a larger group or company.

This collaboration can offer more diverse financial services to customers.

ICICI Group, which includes ICICI Bank and ICICI Securities, is an example.

Chain Banking

Chain banking is when one company owns and controls multiple banks.

These banks may have different names, but they all answer to the same parent company.

It’s like a network of banks under one umbrella.

Correspondent Banking

Correspondent banking is a partnership where banks help each other serve customers in different locations.

For instance, a small local bank might use services from a bigger bank to offer more options to its customers.

It’s a way for banks to work together and provide better services.

I think these above point should give you a clear overview of the various types of banks based on organization and the role of the central bank.

Banks come in different shapes and sizes, each providing specific purposes to meet the diverse financial needs of individuals and businesses.

Was this helpful?

0 / 0