Introduction to Break-even Quantity

Break-even quantity is a crucial concept in business management. It helps business owners understand the minimum number of units they must sell to cover their costs and start making a profit. By determining their break-even quantity, business owners can make informed decisions about pricing, production, and investments. In this article, we will explore the break-even equation, fixed and variable costs, determine the selling price, calculate the break-even quantity, interpret the results, and use the break-even quantity for business management.

{tocify} {$title=Table of Contents}

The Break-even Equation

The break-even equation is use to calculate the break-even quantity. The equation is simple:

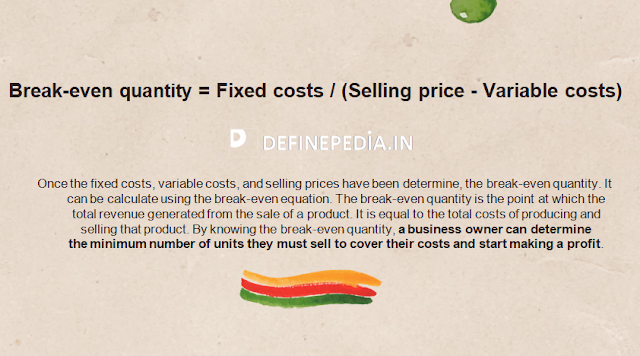

Break-even quantity = Fixed costs / (Selling price – Variable costs)

Break-Even Point Calculator

Fixed costs (FC) are costs that do not change regardless of the number of units produced or sold. Such as rent, insurance, and salaries.

Variable costs (VC) are costs that change with the number of units produced or sold, such as materials, labor, and shipping.

Understanding Fixed Costs and Variable Costs

It is important to understand the difference between fixed and variable costs to properly use the break-even equation. Fixed costs are expenses that are incurre regardless of the number of units produced or sold.

For example, rent for a business location is a fixed cost. Variable costs, on the other hand, are expenses that vary with the number of units produced or sold.

For example, the cost of raw materials used to produce a product is a variable cost.

Determining the Selling Price

The selling price is the amount at which a business intends to sell its products. It is crucial to determine the selling price in order to accurately calculate the break-even quantity. The selling price should take into consideration not only the costs of production. But also the desired profit margin. A business owner must determine the optimal selling price by balancing the cost of production. The desired profit margin, and the market demand for the product.

Calculating the Break-even Quantity

Once the fixed costs, variable costs, and selling prices have been determine, the break-even quantity. It can be calculate using the break-even equation. The break-even quantity is the point at which the total revenue generated from the sale of a product. It is equal to the total costs of producing and selling that product. By knowing the break-even quantity, a business owner can determine the minimum number of units they must sell to cover their costs and start making a profit.

Interpreting the Results

The results of the break-even calculation can be use to make informed decisions about pricing, production, and investments. If the calculated break-even quantity is high. The business owner may need to consider lowering the price, reducing fixed costs, or increasing production efficiency to reach the break-even point. If the calculated break-even quantity is low, the business owner may have room to increase the selling price or invest in marketing and product development.

Using the Break-even Quantity for Business Management

The break-even quantity is a valuable tool for business management. By regularly calculating the break-even quantity, a business owner can make informed decisions about pricing, production, and investments. They can also use the break-even quantity to set goals and observe the success of their business over time. By understanding the break-even quantity, a business owner can make strategic decisions. It will improve their bottom line and help their business grow.

Conclusion

In conclusion, break-even quantity is a crucial concept in business management. By understanding the break-even equation, fixed and variable costs, determining the selling price, calculating the break-Even Point

Was this helpful?

0 / 0