The trial balance is important in accounting for checking arithmetical accuracy, assisting in preparing financial statements, rectifying errors, and making adjustments.

Trial balance errors are common but fixable and can be caused by mistakes in recording transactions or incorrect calculations.

Trial balance errors occur when the debit and credit columns do not match, which can happen due to various reasons such as incorrect journal entries, posting errors, or missing transactions.

However, it is reassuring to know that trial balance errors are common but fixable. So by identifying and correcting these errors, businesses can provide the accuracy of their financial statements and make informed/right decisions based on reliable data.

Types of Trial Balance Errors

There are different types of accounting errors, but the most common ones are

clerical mistakes or errors of accounting principles. However, regarding trial balance errors, there are two types: errors of omission and errors of commission.

Errors of omission occur when a transaction is fully skipped, while errors of commission occur when a wrong amount is entered in the journal or ledger. Errors of principle are also consider critical trial balance errors that can affect the accuracy of financial statements. These types of errors happen when an accounting principle is not followed correctly.

- Clerical errors are mistakes made by office workers while performing their duties.

- They can be caused by oversights, typographical errors, or unintentional addition or omission of a word, phrase, or figure.

- Examples of clerical errors include transposition errors, posting errors, and calculation errors.

- Transposition errors occur when digits or letters are reversed.

- Posting errors occur when an entry is made in the wrong account.

- Calculation errors occur when an incorrect formula is used or when the numbers are added, subtracted, multiplied, or divided incorrectly.

- To identify and correct clerical errors, one needs to follow specific steps.

- Errors of principle refer to mistakes made in the fundamental accounting principles. Such as incorrect allocation of expenses, incorrect valuation of assets, and incorrect recognition of revenues.

- To identify and correct errors of principle, one needs to understand the principles and their proper application.

- Trial balances can be used to detect bookkeeping errors and have limitations.

Clerical errors

Clerical errors are mistakes that occur during the process of writing, copying, or transcribing information. These errors are usually unintentional and can have a significant impact on the accuracy of a document or record. Examples of clerical errors include transposition errors, posting errors, and calculation errors.

Transposition errors occur when two digits or letters are accidentally swap. For example, if the number 1234 is transposed, it can become 1324.

Posting errors occur when information is enter into the wrong account or column, while calculation errors happen when incorrect mathematical calculations are performed.

Identifying and correcting clerical errors is essential to ensure the accuracy of records and documents. One way to identify clerical errors is to proofread the document carefully, paying close attention to numbers and figures.

Additionally, double-checking calculations and reviewing the information entered into each field can help to catch any errors.

To correct clerical errors, the original document should be located, and the error should be identify. Then, the correct information should be enter in place of the error, and the document should be rechecked for accuracy.

Errors of principle.

Errors of principle are different from clerical errors in that they involve incorrect accounting practices or principles. These errors occur when the accounting treatment applied to a transaction is not in line with accounting standards or generally accepted accounting principles.

Examples of errors of the principle include incorrect allocation of expenses, incorrect valuation of assets, and incorrect recognition of revenues. For example, if a company records an expense as an asset, this is an error of principle. Because it violates the accounting principle of matching expenses with revenues.

Identifying and correcting errors of principle can be more complex than identifying clerical errors. The first step is to review the accounting principles and standards to determine. Whether the transaction has been accounts for correctly. If an error of principle is found, the original transaction should be correct. And the impact on the financial statements should be consider.

How to correct errors affecting a single account?

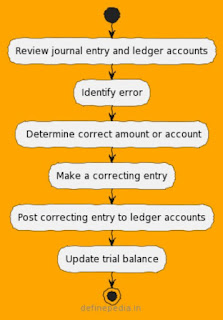

To correct errors affecting a single account, follow these steps:

1. Identify the error by reviewing the journal entry and ledger accounts.

2. Determine the correct amount or account to be debited or credited.

3. Make a correcting entry to adjust the balance of the affected account.

4. Post the correcting entry to the ledger accounts and update the trial balance.

Identify the error by reviewing the journal entry and ledger accounts.

The first step in correcting errors affecting a single account is to identify the mistake. Review the journal entry and ledger accounts to determine where the error occurred. It is important to be careful during this step, as missing an error can lead to further issues down the line.

Determine the correct amount or account to be debited or credited.

After identifying the error, determine the correct amount or account that should have been recorded. This step requires attention to detail, as any mistakes in determining the correct amount or account can lead to further errors.

Make a correcting entry to adjust the balance of the affected account.

Once you have determined the correct amount or account, make a correcting entry to adjust the balance of the affected account. This entry should be made in the same journal entry as the original mistake.

Post the correcting entry to the ledger accounts and update the trial balance.

Finally, post the correcting entry to the ledger accounts and update the trial balance. This step ensures that the corrected information is reflected in the financial records and helps prevent future errors.

Example: To make the correction, a journal entry of $1000 must be added under salary expense (debit) and $1000 added as salary payable (credit). Errors from the previous year can affect your current books.

The way around this is to add backdated correcting entries. For example, the mistake in the previous example was made in 2022.

Errors Affecting Multiple Accounts

One of the most common types of accounting errors is errors affecting multiple accounts. This happens when a transaction is recorded incorrectly, causing an imbalance in more than one account.

For example, if you record a payment to a supplier as a debit to the accounts payable account but a credit to the accounts receivable account, it can result in an imbalance in both accounts.

Another type of error is the error of commission, which occurs when a bookkeeper or accountant records a debit or credit to the correct account but to the wrong subsidiary account.

For example, if you record a payment to a supplier correctly but apply it to the wrong invoice, it can cause an imbalance in the accounts payable account.

Errors of omission occur when a transaction is overlooked and not recorded, leading to an incorrect balance in the account. Other hand, errors of duplication happen when the same item of income or expense is enter more than once, resulting in an overstatement of the account balance.

To find problems affecting numerous accounts, examine the journal entries and ledger accounts for inconsistencies. Check for transactions that were maybe records in the improper account or with inaccurate amounts.

Once you identify the errors, it’s essential to correct them promptly to ensure accurate financial statements and prevent further complications.

To avoid such errors in the future, it is essential to set up processes for identifying these accounting problems. You can, for example, employ accounting software to reduce the probability of data entry errors or have a second person evaluate your financial records to spot any inaccuracies.

So we can say that accounting errors can happen, and it is essential to be aware of them and take corrective action as soon as possible. So for that always remember to review your financial records regularly/frequently. And have processes in place to detect any errors promptly. This allows you to keep accurate financial records and make informed company decisions.

Was this helpful?

0 / 0