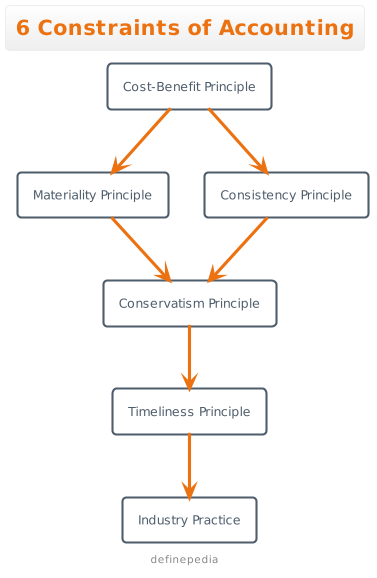

Here are 6 constraints of accounting:

- Cost-Benefit Principle

- Materiality Principle

- Consistency Principle

- Conservatism Principle

- Timeliness Principle

- Industry Practice

Cost-Benefit Principle

The cost-benefit principle is an important accounting concept that emphasizes that the benefits of an accounting system should outweigh the costs involved. So it is a fundamental principle that helps businesses make strategic decisions to increase profits and prioritize growth.

Simply expressed, the cost-benefit principle assists businesses in determining. If the advantages of a specific decision or action outweigh the related costs.

Businesses can make more informed decisions that are more likely to lead to success by studying and comparing the costs and advantages of a decision.

In the point of view of accounting, the cost-benefit principle is applied in various ways. For example, while deciding whether to introduce a new accounting system. A company will assess the expenses of doing so. Such as purchasing software, training employees, and hiring consultants.

They will then weigh these costs against the benefits the new system will bring. Such as increased efficiency, improved accuracy, and better financial reporting.

Another example of how the cost-benefit principle is applied in accounting is through forensic accounting. In cases of suspect financial fraud, forensic accountants are brought in to investigate and uncover evidence of wrongdoing.

The cost-benefit principle is apply in this case by determining whether the potential benefits of the investigation (such as recovering stolen assets, preventing future fraud, and protecting the company’s reputation) outweigh the costs of the investigation (such as paying for the forensic accountant’s services and potentially disrupting normal business operations).

Materiality Principle

The materiality principle is an accounting principle that states that all items. That are reasonably likely to impact investors’ decision-making must be record or report in detail in a business’s financial statements using GAAP standards.

The materiality principle is important in accounting. Because it ensures that financial statements are accurate and complete, providing investors with the information they need to make informed decisions.

Why is this principle so important? Well, the materiality principle ensures. That financial statements are accurate and complete, providing investors with the information they need to make informed decisions.

It also helps companies avoid over-disclosing insignificant information, which can clutter financial statements. And make it harder for investors to identify the most important information.

So, how is the materiality principle apply in accounting? Let’s say a company has a petty cash fund of Rs 100. While this is technically an asset that should be record, it may not be material enough to impact investors’ decisions.

Other hand, a major legal proceeding or a change in leadership would likely be material and would need to be disclose in the financial statements.

Overall, the materiality principle is a fundamental concept in accounting that ensures financial statements are accurate and complete. It also helps companies avoid disclosing insignificant information.

So by following this principle, accountants can provide investors with the information they need to make informed/right decisions.

Consistency Principle

The consistency principle is an accounting principle that requires a company to use the same accounting methods and procedures consistently over time. This ensures greater accuracy and clarity in financial records.

Examples of how the consistency principle is applied include using the same depreciation method for fixed assets, using the same inventory valuation method, and using the same revenue recognition method.

Consistency is crucial in accounting. Because it allows investors, analysts, and other stakeholders to make informed decisions based on reliable and relevant information.

If a company changes its accounting methods or policies frequently, it can create confusion and make it challenging to evaluate the company’s financial performance over time.

For example, if a company changes its method of inventory valuation from First-In-First-Out (FIFO) to Last-In-First-Out (LIFO). It can significantly impact the company’s report profits and assets. If the company changes its accounting methods every year. It becomes difficult to compare financial statements from year to year and make informed decisions based on them.

Therefore, the consistency principle plays a vital role in maintaining the integrity of financial statements and ensuring. That they reflect the company’s true financial position and performance over time.

In practice, the consistency principle is apply by companies by adopting and consistently using the same accounting policies and methods throughout the current and future financial periods, unless required by law or the change provides a better presentation in the accounts.

For example, a company that follows the FIFO method for inventory valuation should continue to use it in the future, unless there is a compelling reason to change it.

Conservatism Principle

The conservatism principle is an accounting principle that requires accountants to exercise a high degree of verification and utilize caution when preparing company accounts.

This principle requires businesses to recognize expenses and liabilities as soon as possible when there is uncertainty about the outcome. But only recognize revenues and assets when they are assured of being receive.

This approach helps to reduce/minimize the risk of overvaluing assets or just for understating liabilities.

It can lead to misleading financial statements and inaccurate decision-making.

So, the conservatism principle is a safety net that ensures that financial statements are prepare in a cautious and prudent manner. By taking a conservative approach to accounting, businesses can minimize the risk of overestimating future income or underestimating future expenses.

One example of how the ideology principle is apply in accounting is the use of the allowance for doubtful accounts. When a business sells goods or services on credit. Basically, it creates an account receivable.

However, some customers may not pay their bills, which creates a risk of bad debts. To account for this uncertainty, businesses may create an allowance for doubtful accounts. It is a contra-asset account that reduces the reported value of accounts receivable.

This approach reflects the conservative assumption that some customers may not pay their bills, even though they may soon or later do so.

Another example of how the conservatism principle is apply in accounting is the use of the lower of cost or market method for valuing inventory. Under this method, businesses must value their inventory at the lower of its cost or its market value.

This approach reflects the conservative assumption that inventory may lose value over time. And it ensures that businesses do not overstate the value of their inventory on their financial statements.

So this means that all probable losses are recorded when they are discovered, while gains can only be registered when they are fully realized.

Here is an example of how the conservatism principle is apply including recognizing bad debts, writing down inventory to its net realizable value, and creating provisions for warranties.

Timeliness Principle

The timeliness principle is an essential concept in accounting that emphasizes. So the importance of providing relevant financial information to users in a timely manner.

This principle states that financial statements should be prepared and presented as soon as possible after the end of the accounting period. So By doing this, users can make informed/right decisions based on current/present information rather than relying on outdated data.

The timeliness principle is closely related to the relevance principle, which states that accounting information should be capable of influencing the decisions of users.

So by providing timely financial information, businesses can help to ensure that users have access to relevant and up-to-date information when making decisions.

This approach can help to build trust and confidence in the financial statements, which is essential for maintaining strong relationships with investors, creditors, and other stakeholders.

One example of how the timeliness principle is applied in accounting is the preparation of interim financial statements. These statements provide users with information about a business’s financial performance and position during the course of the year.

So by preparing and presenting these statements in a timely manner, businesses can help to ensure that users have access to current and relevant information when making decisions.

Another example of how the timeliness principle is apply in accounting is the use of electronic reporting systems. Businesses can now provide users with real-time access to financial information because of the increased use of technology in accounting.

Essentially, this strategy ensures that users have access to up-to-date and relevant information whenever they require it.

Industry Practice

The industry practices constraint is an accounting principle that recognizes that companies in certain industries can use different accounting practices. This is because the nature of certain industries and their practices can need unique accounting treatments.

The importance of this idea is that it enables organizations to report financial information in accordance with industry standards. It enables comparing financial statements between companies in the same industry easier for investors and other stakeholders.

Examples of how industry practice is apply include using LIFO inventory valuation for retail businesses, using the percentage-of-completion method for construction contracts, and using fair value accounting for financial institutions.

Key Points

- Cost-Benefit Principle: The cost of applying an accounting principle should not be more than its benefits.

- Materiality Principle: Items or events having an insignificant economic effect or not being relevant to the users need not be disclosed.

- Consistency Principle: Accounting practices should be followed on a horizontal, basis from one accounting period to another.

- Conservatism Principle: The principle of ‘anticipate no profit but provide for all probable losses’ should be applied.

- Timeliness Principle: Timely information (though less reliable) should be made available to decision-makers.

- Industry Practice: Certain industries may have to deviate from basic accounting principles in order to account for the unique characteristics of that industry.

Was this helpful?

0 / 0