An accounting journal is a detailed record of all the financial transactions of a business, recorded in chronological order. It is also known as the book of original entries. Because it is the first place where transactions are records.

An accounting journal is a detailed record of all financial transactions of a business use to create the general ledger and financial statements. Transactions are records in chronological order as journal entries using the double-entry method of bookkeeping. The purpose of accounting journals is to determine the financial results and status of the organization.

Accounting journal uses occur in your business, such as purchases, sales, and expenses. It allows you to effectively document business activity as it occurs, thus tracking your money.

Before the advent of computerized bookkeeping and accounting, transactions were manually enters into a journal and then posted in the general ledger. This process provided that all financial information was accurately recorded and updated in real time.

The records in an accounting journal are used to produce the general ledger, which is then utilized to create your company’s financial statements. So basically these reports provide a detailed analysis of the company’s financial health, including assets, liabilities, and equity.

A journal is a daily book of accounts that records each transaction through a debit and credit analysis, with an explanation.

It is also known as the primary and subsidiary book of accounts.

Its ability to provide a permanent record of accounts and maintain the continuity of transactions and serve as future references, prevent fraud and cheats, and help resolve future disputes.

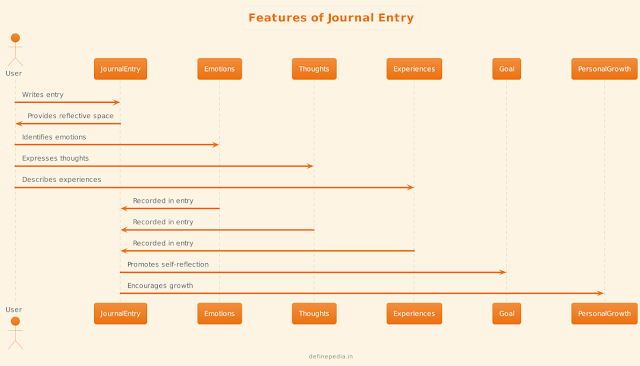

Features of Journal

- The principal book of account is the journal. As a result, the acts as the original record of all financial transactions that take place in a business.

- The journal is a daily book of accounts, which means it is updated every day to reflect any transactions that have occurred. As a result, everyday transaction is noted in the record book.

- The journal is a companion book of accounts. It is used in connection with other accounting books and records.

- A debit-credit analysis is performed on each transaction to guarantee that all financial information is properly captured.

- Each transaction is recorded with an explanation, which provides additional context and details about the transaction.

- Each transaction is recorded by means of a debit and credit analysis of the same amount of money in the journal. It helps ensure that all transactions are balanced.

- The journal is kept in a separate table, making it simple to keep track of transactions and locate information as needed.

- Transactions are recorded chronologically in the journal. It assists firms in keeping track of their financial history throughout time.

- Journal entry includes a detailed explanation of each transaction. It includes the date, amount, and accounts involved.

- It is also known as the book of original entries.

Advantages of Maintaining an Accounting Journal

Organized and systematic recording of transactions

One of the primary advantages of maintaining an accounting journal is that it helps to keep all financial transactions in one place, systematically recorded in chronological order. This allows for easy retrieval of information and ensures that all transactions are recorded accurately.

Helps in identifying errors and fraud

The systematic recording of transactions also makes it easier to identify any errors or discrepancies in the financial statements. By comparing the journal entries with receipts and invoices. Any incorrect or fraudulent entries can be detected and corrected in a timely manner.

Facilitates financial analysis and decision-making

Keeping an accounting journal offers a thorough record of all financial events, allowing financial statements. Such as balance sheets and income statements to be prepared. These statements provide valuable information for financial analysis and decision-making.

Legal compliance and audit readiness

Maintaining an accounting journal ensures legal compliance with accounting standards and regulations. It also ensures that the business is audit-ready, allowing for a smooth audit process if and when required.

Mastery of journal entries is crucial for accounting careers

Journal entries are one of the most important skills to master in the field of accounting. Without proper journal entries, a company’s financial statements would be inaccurate and unreliable.

Debits and credits are easier to understand

Journal entries help to make the concepts of debits and credits easier to understand. Debits always increase asset and expense accounts. The credits always increase liability, equity, and revenue accounts.

Advantages of double-entry accounting

Maintaining an accounting journal allows for the implementation of double-entry accounting, which has several advantages. Double-entry accounting ensures the accuracy and completeness of financial data. It provides a clear picture of the company’s financial condition and facilitates the detection of errors and fraud.

Methods of Accounting Journal

The accounting journal is a method use to record financial transactions in a business’s accounting records.

There are two primary methods of accounting journals: Manual journal entry systems and Computerized accounting systems.

The manual system has been around for hundreds of years but has developed to include multiple journals and ledgers for increased efficiency.

Computerized systems perform some of the steps in the accounting cycle automatically. Regardless of the system used, the functions of accountants include reporting economic events and interpreting financial statements.

The subsidiary ledger is used to keep track of all individual customer accounts and is summarized in a controlling account within the general ledger.

Manual journal entry systems

Manual journal entry systems are the traditional way of recording financial transactions. With this method, all transactions are record by hand in a physical ledger book, using pen and paper. This process can be time-consuming and also include some errors. But it can also be more direct.

Computerized Accounting Systems

It has already been said that computerized accounting systems use specialized software to record transactions automatically. These systems are much faster and more efficient than manual systems and are fewer chances of errors/mistakes. They can also provide more detailed reports, making it easier to analyze financial data.

So here are some special types of entry. The first one is the reversing entry, which is an entry that is either reversed manually in the following reporting period or automatically reverse by the accounting software.

This type of entry is often use to correct errors or adjust entries that were made in the wrong accounting period.

Another type of entry is the recurring entry, which is a transaction that occurs regularly, such as a monthly rent payment. This type of entry can be automate in a computerized accounting system, making it easier to manage and reducing the risk of errors.

Was this helpful?

0 / 0